Table of Contents

Introduction

Accidents are unexpected and stressful. In addition to the physical and emotional pain, medical bills can be very difficult to deal with. That’s where insurance companies come in. But how do insurance company pay accident medical bills? Understanding this process is extremely important for accident victims and their families, especially in the United States, where healthcare costs are high. This comprehensive guide explains how an accident medical bill works, who pays what, and how you can get the most out of your insurance policy.

1. What Happens After an Accident?

After an accident, the first priority is to seek medical attention. Whether it’s a car accident, a workplace injury, or a fall, emergency services and hospitalizations often result in high bills. These costs include:

• Ambulance charges

• Intensive care unit visits

• Surgery

• Hospital stays

• Medications

• Rehabilitation and physical therapy

But how do insurance company pay accident medical bills after all this? Let’s explore.

2. Types of Insurance That Cover Accident Medical Bills

Understanding your coverage is the first step in knowing how do insurance company pay accident medical bills. Here are the main types of insurance that may help:

a. Auto Insurance

Most auto policies include:

• Personal Injury Protection (PIP): Covers medical expenses, even if you are at fault.

• Medical Payments (MedPay): Covers your and your passengers’ medical bills.

b. Health Insurance

Health insurance becomes a secondary payment when accident insurance runs out. It covers additional treatment, long-term care, or hospitalization.

c. Workers’ Compensation

If an accident occurs at work, your employer’s workers’ compensation insurance will pay for all reasonable medical expenses and lost wages.

d. Liability Insurance

Covers injuries to third parties. If the other driver is at fault, their liability insurance may cover your medical expenses.

3. The Medical Billing Process Explained

Before understanding how do insurance company pay accident medical bills, let’s simplify the medical billing process:

1. You receive medical treatment.

2. The healthcare provider submits a bill to the insurance company.

3. The insurance company evaluates the claim.

4. They approve, deny, or partially pay the bill.

5. If approved, the money is sent directly to the provider or you are reimbursed.

4. How Do Insurance Company Pay Accident Medical Bills?

Now, the core question: How do insurance company pay accident medical bills?

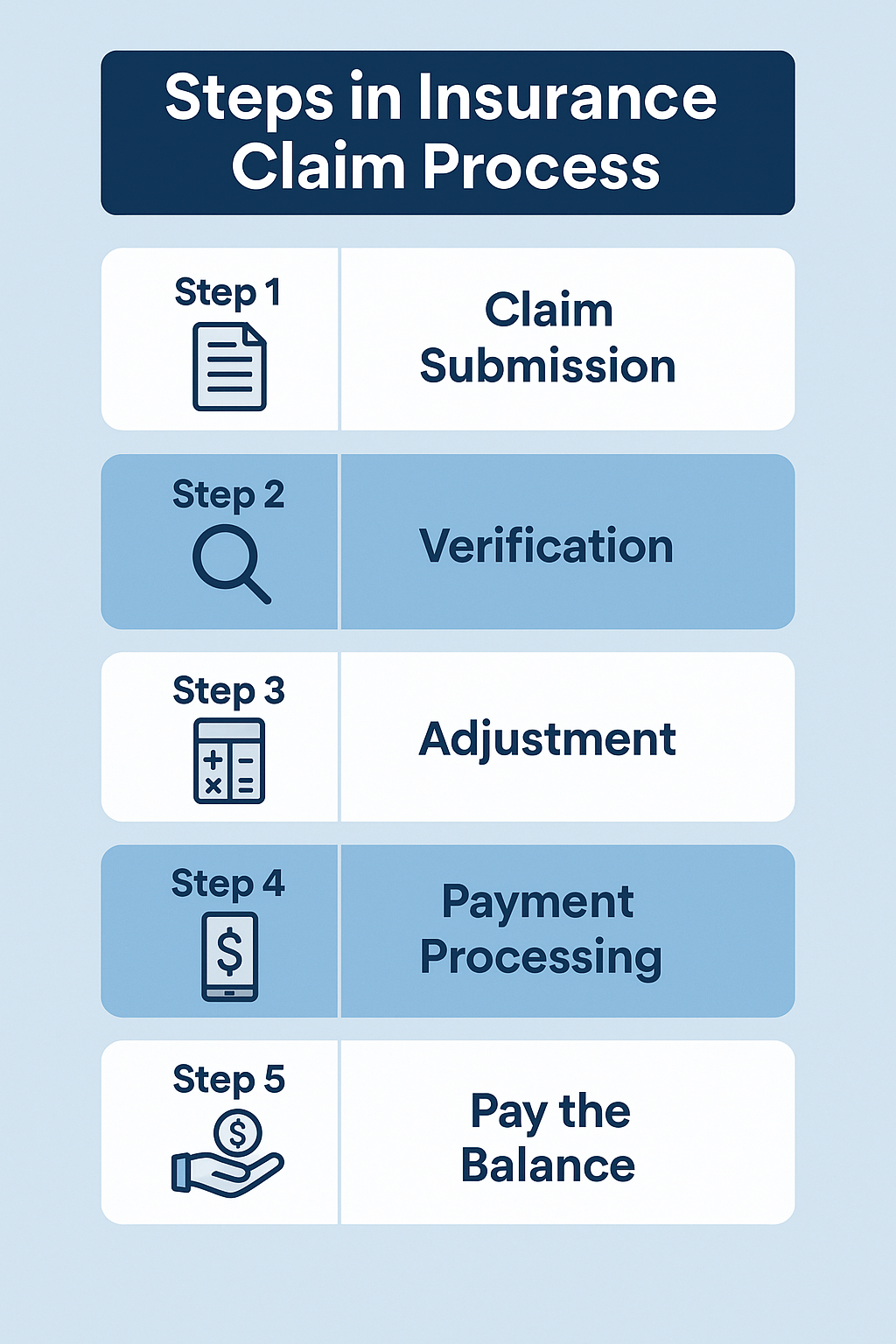

Here’s how the process typically works:

Step 1: Submitting a claim

Your doctor or hospital submits a claim to your insurance company using a medical billing code. You’ll need to provide your policy details and an accident report, if required.

Step 2: Verification

The insurance company checks your eligibility, policy coverage, and whether the treatment is medically necessary.

Step 3: Adjustment

Insurance companies apply negotiated rates or deductibles to reduce the bill.

Step 4: Payment process

If approved, the insurance company sends payment to the provider (or to you if you paid in advance). An Explanation of Benefits (EOB) explains what was paid and what your responsibilities are.

Step 5: You pay the balance

You may be responsible for co-payments, deductibles, or any services that are not covered.

✅ Pro tip: Always keep your receipts, accident reports, and communications with your insurance company in one place.

5. What Is Coordination of Benefits (COB)?

When multiple insurance plans are involved, insurance companies use a process called ‘Coordination of Benefits’. This determines which insurance company pays first and who covers the rest.

For example:

• If you have both health insurance and auto insurance, auto insurance (PIP or MedPay) usually pays first.

• Health insurance covers the remaining bills after the PIP/MedPay limit is reached.

This ensures no duplicate payments and proper cost allocation.

6. Role of Subrogation in Medical Billing

Subrogation means that the insurance company has the legal right to collect money from the at-fault party’s insurance.

Here’s how it works:

• Your insurance pays your bill initially.

• They then seek reimbursement from the at-fault party’s insurance company.

This process can take months, but you still get the care you need.

So, how do insurance company pay accident medical bills while you wait for fault to be determined? With subrogation, you don’t have to delay getting care.

7. Steps to File an Insurance Claim for Accident Medical Bills

To make sure your claims are paid promptly, follow these steps:

- Seek immediate medical care.

- Report the accident to relevant parties (employer, car insurer, police).

- Get a copy of the accident report.

- Collect medical records and bills.

- Submit the insurance claim along with all documents.

- Follow up regularly.

- Hire a claims specialist or attorney if needed.

Being proactive improves your chances of getting full compensation.

8. Common Delays and Denials in Payment

Even if you follow all the steps, claims can still be delayed or denied. Common reasons include:

• Incomplete documentation

• Policy exclusions

• Pre-existing condition disputes

• At-fault disputes

• Missed deadlines

Understanding how insurance companies pay accident medical bills means being prepared for appeals. If a claim is denied, you can:

• Ask for a written reason

• Submit additional evidence

• File an internal appeal or go to third-party mediation

9. Tips to Ensure Smooth Claim Settlement

To ensure your accident medical bills are covered:

- Know your policy — understand what’s covered and what’s not.

- Don’t delay medical treatment — immediate care strengthens your claim.

- Keep all records — medical bills, prescriptions, reports.

- Follow up — stay in touch with insurers.

- Consult a lawyer — especially for serious accidents or high bills.

Most importantly, don’t panic. Learning how do insurance company pay accident medical bills puts you in control of your recovery.

10. Final Thoughts

Ultimately, how do insurance company pay accident medical bills depends on the type of insurance, the severity of the accident, and how well you manage the claims process. From auto insurance to health policies to workers’ compensation, each plan has its own process. Understanding your rights and responsibilities is the best way to avoid financial stress after an accident. Accidents happen, but your finances shouldn’t suffer. Educate yourself about your insurance options and protect your health — and your wallet.

FAQs on How Do Insurance Company Pay Accident Medical Bills

Q1. Can I choose my own doctor after an accident?

Q2. How long does it take for insurance to pay accident medical bills?

Q3. What if I don’t have insurance at the time of the accident?

Q4. Do insurance companies pay all bills automatically?

Q5. What if the insurer denies my claim?

Disclaimer

This post is for informational purposes only and does not constitute legal or insurance advice. Please consult a licensed professional for guidance specific to your situation.